The Amazon advertising partnership network now spans Netflix, e.l.f.YOU! channel, and SiriusXM, signaling a stronger push into streaming, audio, and retail media integration.

Amazon’s reach keeps growing, but advertisers face a new challenge: keeping up.

In 2025, Amazon Advertising isn’t just evolving; it’s expanding into every corner of media.

With ad-supported offerings now reaching over 275 million people in the U.S., brands must rethink how to stay visible and competitive across this fast-changing landscape.

Amazon Ads and Twitch Launch Shoppable Live Streams with e.l.f.

Alicia Lueerssen-Medina , Social Media Manager & Strategist at Aktiva"This move makes the customer journey smoother, removing the steps of leaving the platform to buy products, making purchases MORE likely."

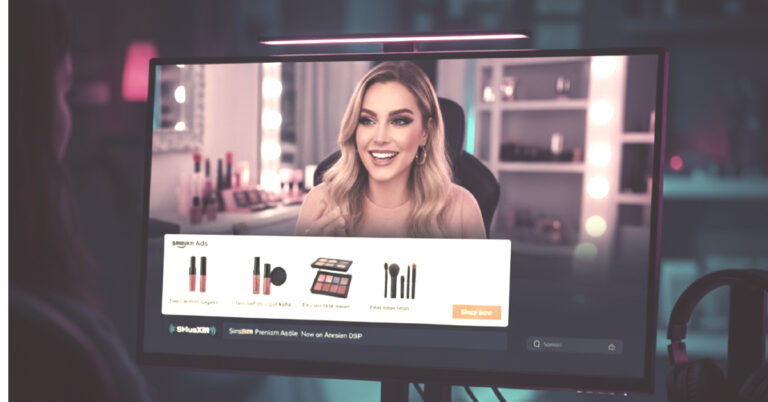

e.l.f. Cosmetics, a brand from e.l.f. Beauty, announced an innovative partnership with Twitch, powered by Amazon Ads, to become the first brand to run an all-new and native in-stream live-shopping element on the popular streaming service. This collaboration capitalizes on the brand’s existing popularity within the Twitch community to merge entertainment with e-commerce.

The new feature, called the “eyes.lips.first.” shoppable element, allows viewers to buy products directly from a live stream. This process is designed to be seamless, ensuring the audience can make a purchase without ever interrupting their viewing experience.

This ad format aims to connect brands with highly-engaged online communities in an authentic way. It turns creator-driven moments into opportunities for product discovery and conversion.

The partnership is a natural step for e.l.f., which has built a significant presence on Twitch since launching its e.l.f.YOU! channel in 2020. The channel was created to empower female gamers and celebrate creativity at the intersection of beauty and streaming culture.

The brand’s success on the platform provides a strong foundation for this new shoppable ad format. The e.l.f.YOU! channel has achieved significant engagement, including:

- Over 43.3 million minutes watched

- More than 800,000 chat messages

- Over 64,400 minutes of streamed content

Further details about this partnership will be discussed at the upcoming TwitchCon San Diego 2025. The event is scheduled to take place from October 17-19.

Amazon DSP Taps Into Audio with SiriusXM Partnership

As reported by Elle Kehres on RadioWorld, Amazon Ads and SiriusXM have announced a new audio advertising partnership. This deal allows marketers using the Amazon Demand-Side Platform (DSP) to access SiriusXM’s digital audio portfolio, which includes both Pandora and SoundCloud U.S.

For the first time, brands on Amazon DSP can reach SiriusXM Media’s 160 million monthly digital listeners. This enables advertisers to extend their campaigns to a highly-engaged audio audience using Amazon’s first-party signals.

The technical integration happens through the AdsWizz Supply Side Platform, starting with SiriusXM’s music library. An expansion to include the SiriusXM Podcast Network is also planned for the near future.

This partnership combines Amazon’s deep audience insights with SiriusXM’s premium audio content. It fundamentally reimagines how audio can be integrated into broader advertising strategies.

Through this deal, advertisers gain several new capabilities. These tools are designed to deliver more precise and effective campaigns.

- Advertisers can now pair SiriusXM’s streaming and podcast inventory with Amazon’s first-party shopping and browsing data.

- They can use AI-based optimization tools on Amazon DSP to deliver ads to the most relevant audio audiences.

- The partnership allows for the integration of SiriusXM audio elements into visual ad campaigns.

Amazon Ads and SiriusXM will begin rolling out this expanded access to select advertisers in the fourth quarter of 2025. This move aims to close the gap between time spent with audio and corresponding ad spend.

Amazon Ads and Netflix Unite to Expand Global Streaming Reach

MartechView Editors reported that Amazon and Netflix have formed a partnership to integrate Netflix’s premium ad inventory directly into Amazon’s DSP, streamlining TV ad buying for marketers worldwide. The agreement marks a significant expansion of Amazon’s reach into connected TV and premium streaming environments.

Advertisers using Amazon DSP will gain direct access to Netflix’s global ad inventory across 11 major markets, including the United States, United Kingdom, France, Spain, Mexico, Canada, Japan, Brazil, Italy, Germany, and Australia. The new integration is set to roll out in Q4 2025.

This collaboration allows marketers to manage their video and TV planning within a single platform while gaining access to Netflix’s engaged subscriber base. The integration simplifies campaign execution and improves visibility into performance metrics through Amazon’s first-party insights.

Key highlights of the partnership include:

- Direct programmatic access to Netflix’s global ad inventory through Amazon DSP

- Unified campaign management across streaming and retail media channels

- Expanded targeting precision using Amazon’s audience and behavioral data

- Simplified TV ad buying for brands across multiple international markets

The partnership strengthens Amazon’s growing ecosystem of media integrations and signals the company’s continued expansion beyond retail into entertainment-driven advertising. It positions Amazon Ads as a central hub for cross-platform media planning and execution.

Amazon’s Expanding Grip on the Ad Landscape

As Ronan Shields wrote on Digiday, Amazon is primed to take over the ad industry, a fact underscored by its heavy presence at Advertising Week New York. The company’s ambitions now stretch far beyond sponsored product ads to include audio, gaming, sports, and streaming content.

Amazon’s core advantage is its unique ability to connect trillions of first-party retail data points with ad exposure. This allows advertisers to accurately measure the link between their campaigns and actual purchasing behavior.

As our Amazon agency previously reported, a major move in this expansion is the absorption of Microsoft’s demand-side platform, Microsoft Invest. By March, Microsoft’s ad buying arm will be retired, with its advertisers migrated directly into Amazon’s ecosystem.

This consolidation weaves more of the open web into Amazon’s DSP. Advertisers coming from Microsoft will gain several key advantages:

- Preferential access to ad inventory

- Performance insights tied directly to Amazon’s retail data

- Potentially lower take rates on ad spend

This deal is part of a larger strategy that includes partnerships with Roku, Disney, Netflix, Spotify, and SiriusXM. In the U.S. alone, Amazon DSP clients can now reach approximately 80 million connected TV households.

Amazon is also competing aggressively on price. While typical DSP fees range from 4% to 8%, Amazon has reportedly dropped its take rates to as low as 1%, or even zero in some cases.

This combination of reach, measurement, and price creates a powerful pitch for advertisers. However, this shift is also driven by internal profitability goals, with advertising expected to become a core business pillar much like Amazon Web Services (AWS).

The strategy is already showing results. In the second quarter alone, Amazon’s ad business generated $15.7 billion in revenue, a 22% increase year-over-year, largely driven by the momentum of its DSP.

Lawrence Nga, The Motley Fool"Amazon isn't just another player in digital advertising - it's building a vertically integrated ecosystem."