Meet our contributing author from Margin Business, experts in Amazon SEO, translation, and localization. With 10+ years of experience, they help brands succeed across global marketplaces through native-language strategies and tailored listing optimization.

Omar Angri

Omar Angri is the CEO and Co-Founder of MarginBusiness, a global Amazon agency helping brands expand through expert listing optimization and full account management. With over 15 years of experience, Omar has guided hundreds of sellers and aggregators in scaling across Europe, the Middle East, and the US.

Known for his multilingual team and deep localization strategies, he’s now focused on the booming Amazon UAE and Saudi markets. Omar is a trusted voice in e-commerce, building bridges for sellers looking to grow in less saturated, high-opportunity regions.

While Amazon.com in the US remains the largest global marketplace, sellers worldwide are increasingly drawn to the rapid growth of Amazon UAE (Amazon.ae) and Amazon KSA (Amazon.sa). These expanding platforms offer less competition, growing consumer interest, and an easier start, especially for international sellers.

The appeal of these markets is rising as e-commerce reshapes global retail. With more internet access, smartphone use, and government support for digital efforts, the UAE and KSA are becoming major e-commerce hubs. Sellers who spot this potential early can gain a significant edge.

Amazon has entered the Middle East, yet big opportunities still exist for newcomers. Compared to the crowded Amazon US market, the UAE and Saudi Arabia offer fresh possibilities for sellers with unique products and well-crafted listings. This region is quickly becoming a place where businesses don’t just sell, but also significantly impact the economy.

Given this evolving landscape, identifying the key differences could define your success in Amazon UAE and KSA in 2025. Understanding how localized product listings and effective Amazon account management, as supported by Margin Business and a capable Amazon agency, can unlock the distinct advantages of these Gulf markets might just be the insight you’ve been searching for.

Table of Contents

1. E-commerce Growth in the Middle East: The Numbers Speak

The Middle East is witnessing an unprecedented e-commerce boom, with the UAE and Saudi Arabia leading the charge:

- The UAE e-commerce market is projected to reach $17 billion by 2025 (Statista).

- Saudi Arabia’s e-commerce market is set to exceed $20 billion by 2025, driven by high smartphone usage, government support for digital transformation, and a young, tech-savvy population (MIT Technology Review Arabia).

These figures highlight the exponential growth in the region, positioning the UAE and Saudi Arabia as emerging markets that global sellers can no longer afford to ignore. In contrast to the mature Amazon US market, which is growing at a slower pace due to intense competition, high PPC costs, and stringent regulatory requirements, these markets offer fresh opportunities with much less competition.

As more international brands flock to the UAE and KSA to meet rising demand, the competition may increase, but the early movers can still benefit from a first-mover advantage, building their brands before the market becomes saturated. These two markets are projected to continue their rapid growth for at least the next 5–7 years, providing ample time for businesses to scale successfully.

2. Lower Competition = Easier Entry

Unlike Amazon US, where new sellers face stiff competition from millions of established brands, Amazon UAE and KSA are relatively new markets. As a result, sellers have:

- Fewer competitors

- Wide product gaps across multiple categories

- High demand for international brands

According to a report by RedSeer, over 65% of online shoppers in the GCC prefer international products (RedSeer). This preference for international brands means that sellers entering these markets with a unique offering are more likely to stand out and succeed.

The lower level of competition allows new sellers to enter with greater ease, targeting niche markets that remain underserved by local brands. Moreover, the lack of well-established regional players means there’s significant room for international sellers to make their mark and dominate categories that have yet to be fully explored.

For instance, there’s an untapped demand for eco-friendly products, premium consumer electronics, fitness gear, and halal-certified food items. By positioning your products strategically in these growing segments, you can gain market leadership early on. Additionally, having lower competition helps you save on advertising costs, particularly pay-per-click (PPC) campaigns, which are a significant expense for sellers on established Amazon markets.

Amazon offers tools like “Sell Globally” and “Marketplace Product Guidance” to simplify listing setup and assess demand across 21 marketplaces.

Each marketplace has unique rules, so sellers must navigate local restrictions before expanding.

3. Simpler Seller Registration and Logistics

One of the key advantages of selling in the UAE and KSA is the simplified seller registration and logistics setup, which contrasts with the more complex process in Amazon US:

- No need for a local entity: You can sell as a foreign business without setting up a local company.

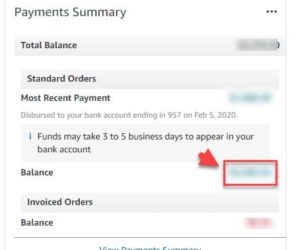

- Global bank account acceptance: You can use Payoneer, Wise, or other global payment providers for your payments.

- Quick seller verification: The verification process is fast, usually taking 1-2 weeks.

- Fulfillment by Amazon (FBA): Amazon offers FBA in both the UAE and KSA, making inventory management and delivery hassle-free.

Compare that to Amazon US, where sellers face significant hurdles:

- Navigating business registration, tax compliance (W9/W8-BEN), and sales tax collection can be overwhelming.

- FBA fees are higher, and competition for FBA storage space is fiercer, leading to increased costs.

More on this: Amazon UAE Seller Central | Amazon KSA Seller Central

By simplifying the registration and logistics processes, Amazon UAE and KSA provide a more accessible platform for international sellers, removing many of the regulatory hurdles that can otherwise delay business operations. The ability to start selling without the need for a local presence or entity is one of the most significant advantages for global sellers.

4. High Purchasing Power & Fast-Growing Customer Base

Both UAE and Saudi Arabia boast impressive purchasing power and a rapidly growing e-commerce customer base:

- The UAE has a GDP per capita of over $46,000 (World Bank), indicating strong buying power.

- Saudi Arabia has over 39 million internet users, with 73% of the population shopping online regularly (DataReportal KSA 2024).

Both countries are experiencing a shift toward digital shopping, with internet penetration rates exceeding 85% in the UAE. As more consumers shift to online shopping, the potential for sellers to capitalize on these markets grows.

In addition to this, both countries are home to an increasingly tech-savvy and affluent demographic that values quality and is willing to pay a premium for international products. From high-end fashion and luxury electronics to organic foods and wellness products, the demand for international products is rising steadily. The growth in smartphone use is also driving the adoption of mobile e-commerce, further expanding the reach of online businesses.

This affluent, internet-savvy customer base, combined with high disposable incomes, makes UAE and Saudi Arabia attractive markets for sellers looking to tap into growing demand. Importantly, high purchasing power translates to consumers willing to spend on premium and luxury products, which many international sellers can capitalize on.

5. Cultural & Strategic Advantages for Halal and Ethical Brands

If your brand aligns with halal, modest, or eco-friendly values, the Gulf region is an ideal market:

- High demand for halal-certified products across food, cosmetics, and pharmaceuticals

- Growing interest in modest fashion, clean beauty, and Islamic home goods

- Strong support for ethical, sustainable, and eco-friendly sourcing

Amazon UAE and KSA are fertile ground for purpose-driven brands, especially those with products that meet the halal and ethical requirements of the region. The increasing awareness and demand for sustainable products, combined with the strong cultural values tied to halal certification, make these markets a natural fit for businesses focused on social responsibility.

Halal certification is a significant factor for consumers in the UAE and KSA, especially when it comes to food, cosmetics, and healthcare products. The demand for these products has seen a consistent rise, and companies offering halal-certified options are positioned to capture a significant share of the market. Furthermore, sustainability is becoming increasingly important to consumers in these regions, with more people seeking products that align with their ethical values.

This growing consumer awareness presents an opportunity for brands to cater to the unique needs of the Middle Eastern market while positioning themselves as ethical leaders in their respective industries.

6. UAE & KSA Government Support for E-commerce

Both governments are deeply committed to fostering e-commerce and digital transformation:

- UAE’s Vision 2031 and KSA’s Vision 2030 prioritize digital commerce, making it easier for foreign businesses to enter these markets.

- Initiatives such as free zones, zero-tax policies, and business-friendly e-commerce licenses are in place to encourage foreign investment and digital business operations. (UAE Digital Economy Strategy)

These initiatives are designed to help international sellers and businesses set up and operate seamlessly in these markets, benefiting from a robust infrastructure and favorable business policies.

For sellers, this means a more streamlined path to market entry and the opportunity to establish a business in one of the most dynamic and forward-thinking regions globally. Government initiatives also ensure that e-commerce businesses can navigate the regulatory environment more easily than in many Western markets.

7. Case Study: Malaysian Seller Succeeds in UAE

A Malaysian lifestyle brand launched on Amazon.ae in 2023 with just one product: a travel-friendly prayer mat. Within six months, it ranked #1 in its category, achieved 30% profit margins, and expanded to Amazon.sa.

How they did it:

- Focused on creating a unique product that was eco-friendly, foldable, and perfect for travelers, catering to both local and international customers.

- Optimized their Amazon listings with relevant keywords in both English and Arabic, following Amazon’s best practices for SEO and product listing optimization.

- Used Amazon’s FBA service to handle logistics and ensure timely delivery.

This case study exemplifies how a small brand can leverage Amazon UAE and KSA’s growing e-commerce platforms to scale quickly. By offering a product that speaks to the needs of the local consumer base while adhering to global standards, this seller was able to rapidly grow their business in the region. The ability to leverage FBA’s infrastructure, while targeting culturally relevant niches, is a major factor in this success story.

8. Bonus: Amazon Aggregators Are Eyeing MENA

Top Amazon aggregators like Opontia and Nabta Health are actively acquiring MENA-based Amazon businesses. The region’s e-commerce growth is seen as a huge opportunity, and aggregators are eager to invest in established Amazon businesses.

By starting your journey in the UAE or KSA now, you position yourself for the potential of a future exit, acquisition, or funding in the next 2-3 years. Early movers are in a prime position to capitalize on this growth, establishing themselves as market leaders in the region.

Final Thoughts: Don't Miss the Window

Amazon UAE and KSA are where Amazon US was in 2012—early, accessible, and full of opportunity. By entering these markets now, you can establish a strong brand presence, benefit from first-mover advantage, and build a business that scales with the region’s growth.

With e-commerce on the rise and global competition intensifying, there’s no better time to take advantage of the opportunities in the UAE and Saudi Arabia. As more international sellers enter the market, the chance to establish a successful business diminishes. The window for expansion is open, and the time to act is now.